I remember watching movies like Clueless and thinking Cher had it all. A cute car, an automated closet, and a credit card that made it feel like money grows on trees. As Em got bigger, Braun and I talked about how to teach not just her (and all of our kids) about money and fiscal responsibility… It started with Em, though.. and slowly added all of our kids to the same thing because IT WORKED!

We had the normal questions like:

How old should your kids be before they get their first debit card?

How do you teach your kids to be responsible about money?

Should you give them an allowance, and if so, how much?

Do you make them “work” for the money by doing household chores?

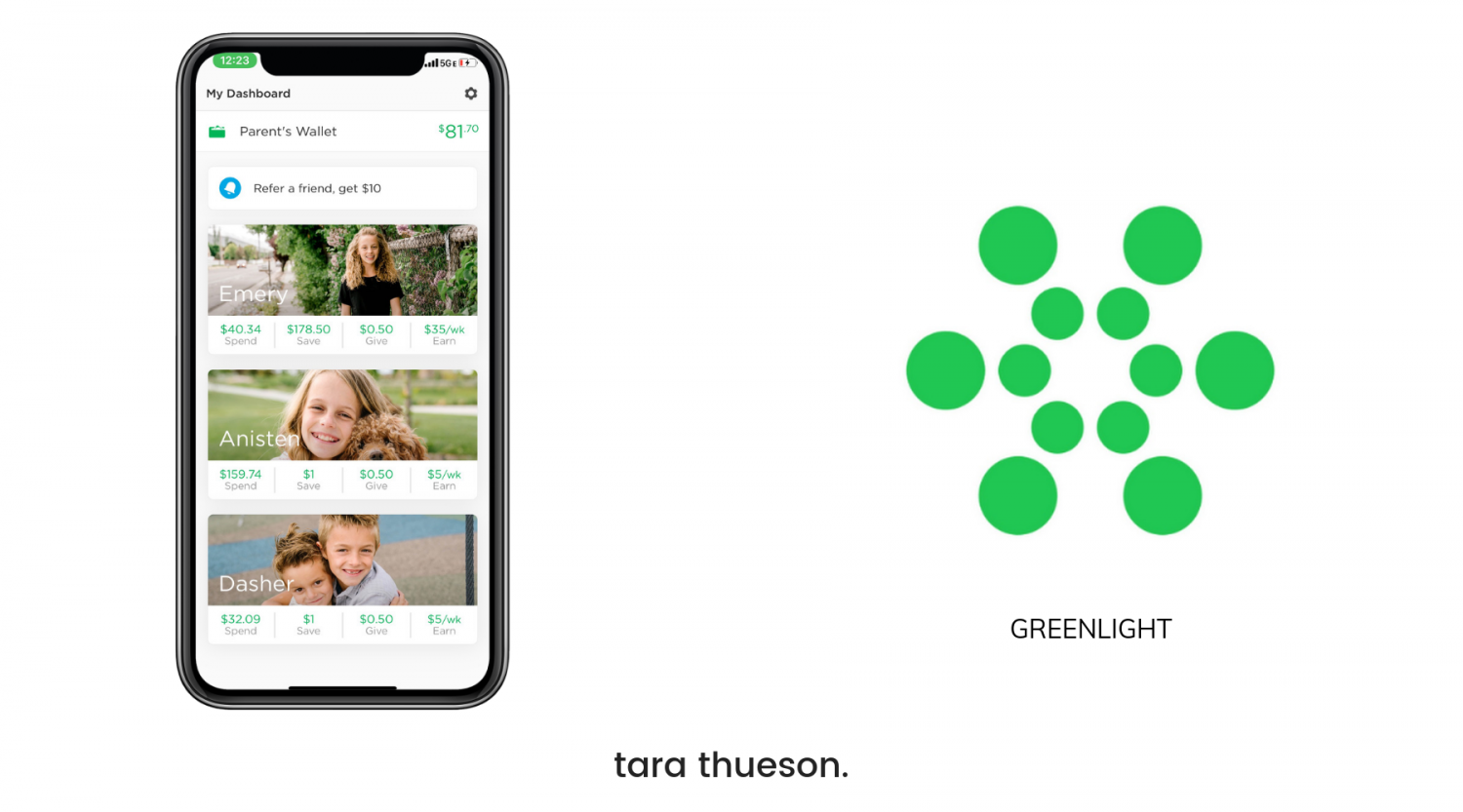

INTRODUCING GREENLIGHT

Choosing what works for your family

The short answer? Every family is different. Every kid is different. But Braun and I both believe that if we want kids who are responsible with money, then we have to trust them with some money to be responsible with. We both know too many adults who have racked up credit card debt that started when they started getting offers in the mail once they turned 18. It was the temptation of easy money without the learned responsibility that comes with that credit.

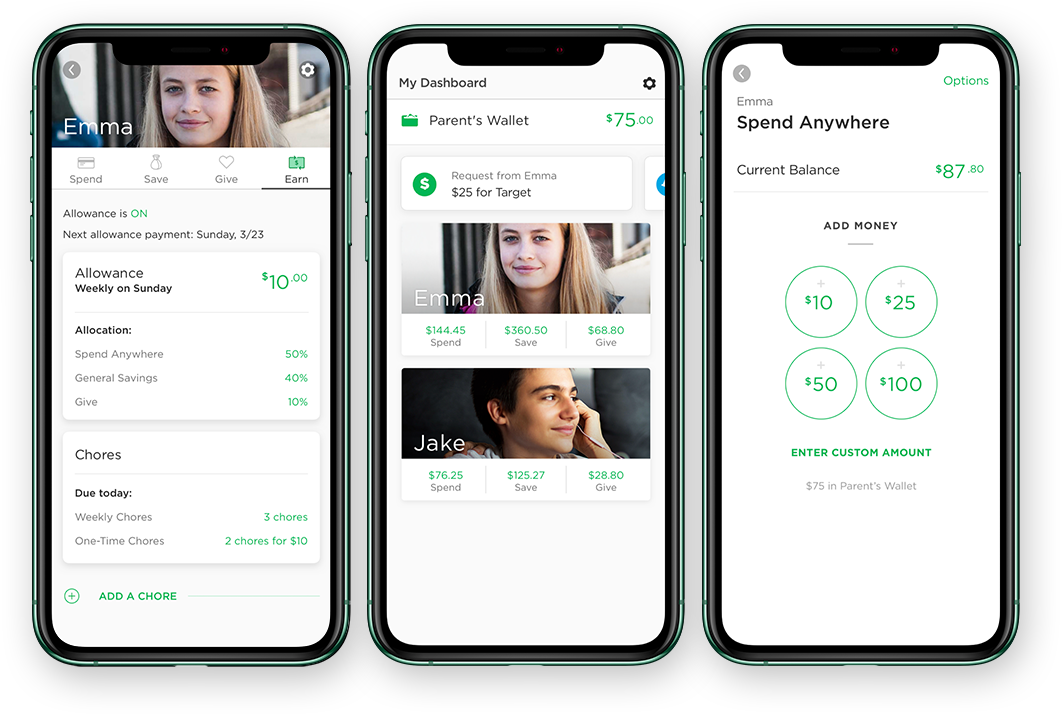

With Greenlight®, you’re able to give your kids pre-paid or funded debit cards that draw directly from your personal bank account. Debit cards are obviously not credit cards, and issuing these to your kids will require you to make that distinction right off the bat. This is one of the aspects I love about this card. My kids know that their own money is what is making these cards work and if they want more money, they can work for it!

It’s also a great way to incentivize my kids to work.

How it Works

To start, the money you give your kid goes into two categories: money they can ‘Spend Anywhere’, and money they can spend ONLY at a store you’ve approved and given a “greenlight” to. The amount of money put into each is controlled by you, the parent. And the amount can be changed at any time instantaneously.

If your child tries to spend at a store you haven’t approved in advance, and they don’t have enough Spend Anywhere money, then their card will be declined. (welcome to real life, kids!) But on the flipside, your kid gets a version of the app too, so the responsibility of checking their balances and permissions before they walk into a store is on them.

Other things I love about Greenlight

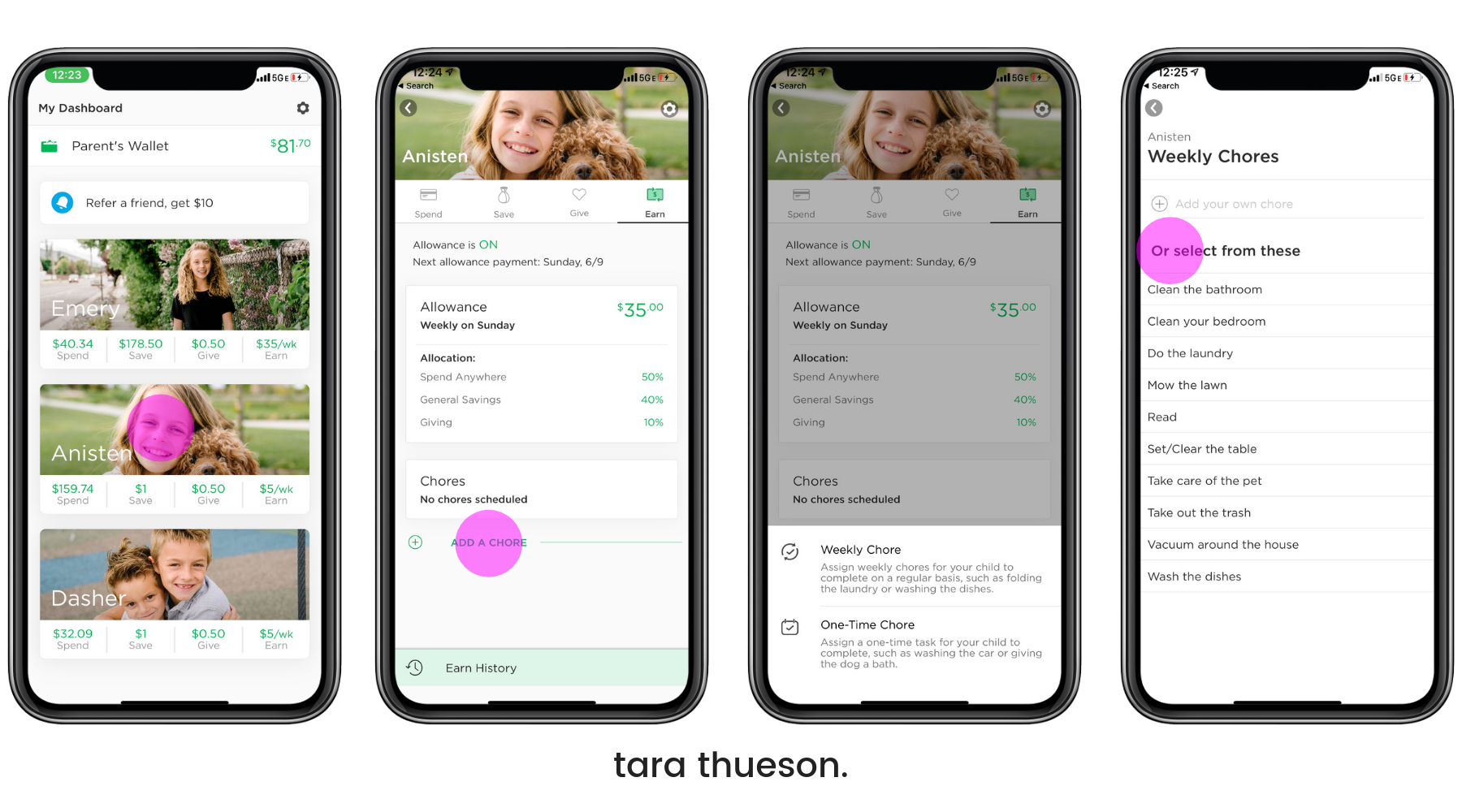

- You Can Set Up a Chore List & Pay an Allowance

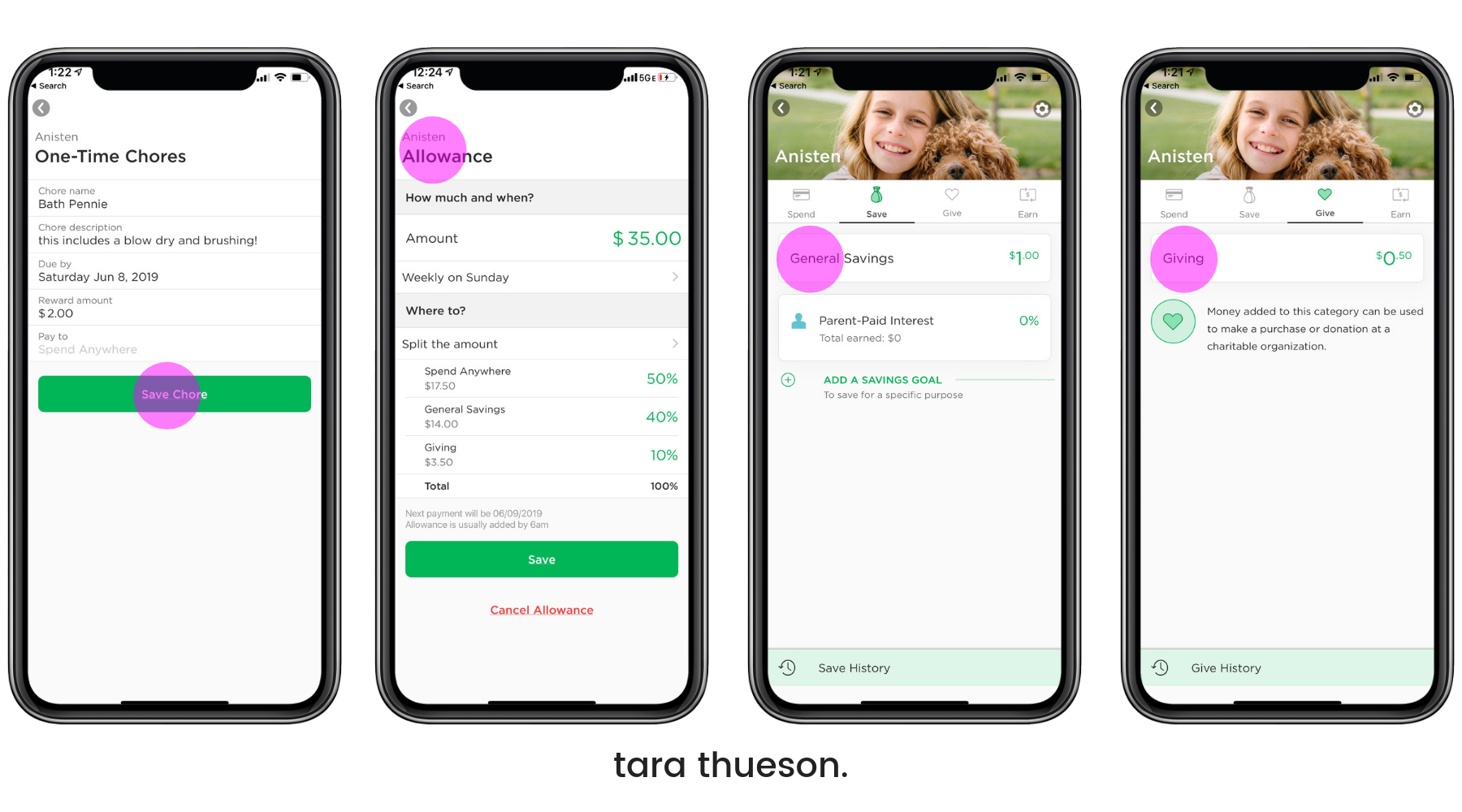

- I don’t love giving an allowance for nothing. Within the app you can automate giving your kid an allowance via the app, though how much money to give them is of course up to you. Braun and I have decided that every chore is worth a certain amount. Since parents may disagree on whether you should make your kid work for the allowance or that you should pay them for helping around the house, you can debate this one among yourselves.

- Kids Can Check Their ‘To-Do’ List & Mark Off Chores As They Complete Them

- Its all about ownership and responsibility.

- I Can Setup Notifications To Remind Me To Review Their Checked-Off Chores & Send Their Allowance

- It Sends Me Updates When My Kids Spend Money

- You can view your kid’s spend history through the app. On their version of the app, kids can check their balance and permissions. You can opt-in to notifications that tell you where and when your kid spends money or in case a merchant declines a purchase. And if it’s special circumstances, Anisten can request more money on the spot!

- Can Automatically Save Money or Send to Charity (tithing)

- One nice feature encourages your kids to put money into a Giving category where they can make charitable donations – we are choosing to use this feature to teach our kids about setting aside money for tithing.

- Money is Transferred Immediately

- Kids App & Parents App

- Both Braun and I manage the kids’ accounts. There is a monthly fee of $4.99 but it covers up to five children in your family.

- Set Daily Limits & Withdrawing Money

- After funding your Parent’s Wallet through your own bank account, you get to dictate how your kid can spend. You can direct funds, for instance, into a Spend Anywhere bucket that is just that; the kid can use the plastic card in any store that accepts a Mastercard. But you can also apportion a set amount of money that can be spent only in stores or types of stores (any restaurant, any gas station, etc.) that you specifically approve of in advance. You can also allow the kid to withdraw cash from an ATM, up to an amount you designate.

- Set Up Spending Limits Specific to Store

- If Anisten is headed to Target with a few friends and I tell her she can only spend $20 – total – I can go into the app and limit her spending capabilities on the spot! If your kid wants to purchase a bigger ticket item than you’ve given them the money for, they can put money into a savings goal account. They would then need your permission to move money out of that account.

- Pay Your Kid Interest

- You can encourage your kids to save their money by paying them a set amount of interest each month based on their balance. The money comes out of your own parent account and hopefully gives the kid the sense that when left alone, their savings balance will grow.

• • •

It’s Safe

Greenlight has built-in safety features. Data and any pictures of your kid that you uploaded are encrypted. There’s a PIN associated with the Greenlight card, and the accounts are FDIC insured. The company also says it has disabled card usage in any store or website that handles or does business in wire transfers, money orders, escort services, massage parlors, lotteries, gambling, horse racing, and dog racing – so you can quickly put a stop to your 7-year old’s gambling ways. (I kid!)

Learning Good Habits Early

At the end of the day, I have to remind myself that any responsible message I’m trying to teach my kids about finance isn’t going to happen overnight. There’s also the HUGE possibility that when my kids first take their cards out on the town, that the money could burn a hole in their pocket. But I see this as a lesson over time, not a one-and-done.

My end goal? To have kids that understand the value of a dollar. Kids that know how to work hard. And kids that, as they turn to adults, will be fastidious with their money and careful with their spending, so they are setup for success so they can afford the important things in life (that cost a lot of money).

Greenlight, The Smart Debit Card for Kids makes it easier to give my kids money and teach them how to make smart financial decisions. Check it out by signing up with my referral link!

Xx Tara

P.S. I hope this helps! If you have other ways you’re teaching your kids money management, let me know in the comments below!

I clicked on your link to sign up & it doesn’t seem like it credited either of us for your referral! maybe it only works on computers not phones?

oh man! Maybe send an email? You should definitely get your first month free!

I would love to hear how you zoned your house for chores. I also am curious what kind of chores do you have your little one doing (I’m assuming it is not the same as the older ones)?

I’m working on writing it all out! I’ll have it up on the blog in the next week!

I wish it was free! Have you heard of a free one Tara?

I haven’t – but I understand why they charge the fee! If you use my link, you get your first month free and can try it out!

What if my kid owes me money? Can I transfer money from greenlight back to my bank account?