Saving money isn’t always fun. Can I be honest? I kinda hate saving money. But I do love when I get to see the payoff of all that saving. Whether it’s completing the basement we’re currently finishing or going on a Disney vacation (we’re mid-cruise as I type), saving has its benefits.

But it’s hard. Don’t believe me? According to a recent study, 58% of Americans have less than $1,000 in savings. Saving money IS a challenge. But it doesn’t have to be. And I’ve partnered with Vimvest who makes saving, giving, and investing simple!

Introducing Vimvest

Had you asked me much about my money knowledge a few years ago, I would have said something glib such as, “I sure know how to spend it!” haha

But the truth is, most people don’t know much about their financial situation and haven’t even thought about saving. But with Vimvest, you can do a little bit of everything.

Vimvest is an app that allows you to save, invest, and give – making big financial concepts easy to understand. It’s as simple as tucking away any predetermined amount into a saving or investing account daily, weekly, or monthly. And it feels good – you’re saving money without even thinking about it! And you’ll be shocked at the impact that pocket change will make in the long run.

Getting Started

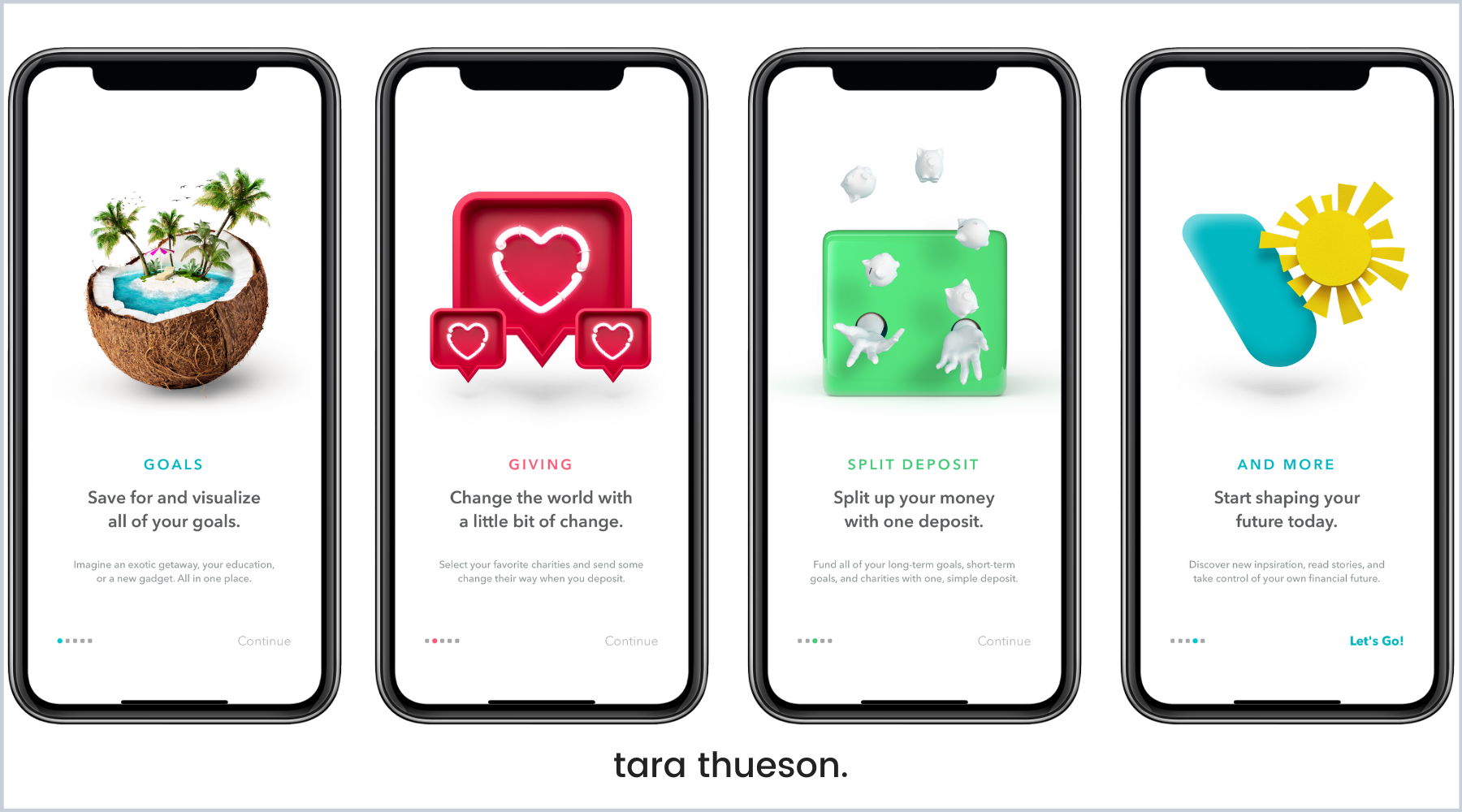

Starting out, you’ve got a few functions that make this app really fun:

GOALS: Set goals for yourself whether it’s for a designer bag, a vacation you’ve been dying to take, or simply beef up your rainy-day stash! Regardless of your goal, you can determine the amount you want to save, a deadline for when you’d like that amount saved, and how frequently you want to contribute to your new goal: Daily, Weekly, or Monthly!

GIVING: Vimvest provides a list of charities to choose from and tracks it for you (tax deductible as well as helping those in need).

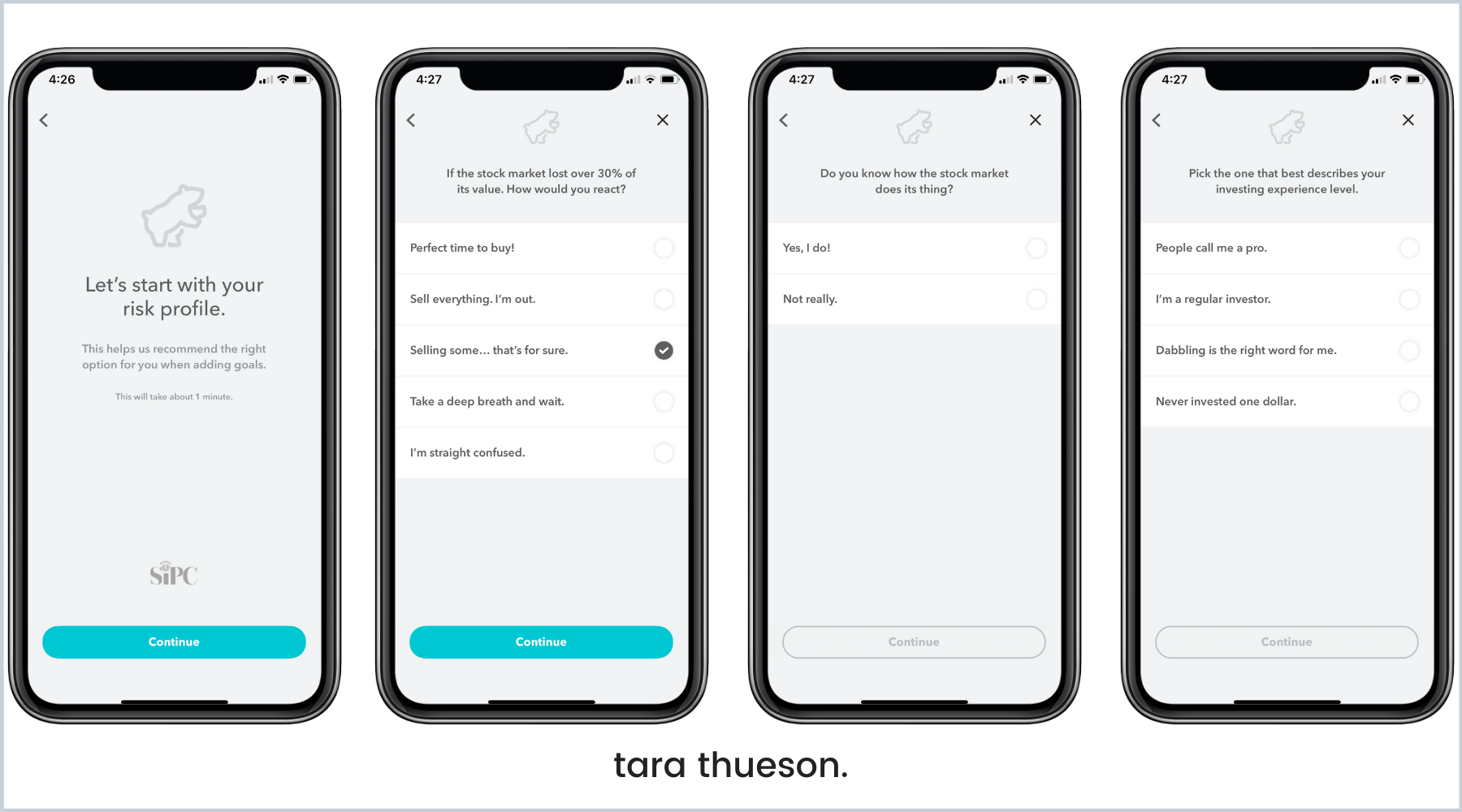

INVESTING: With your long-term financial goals, you have the option to not only save money but to invest that saved money. And you don’t need to know everything about the stock market – Vimvest does the heavy lifting and invests on your behalf in investments that match the level of risk you’re comfortable with.

And with features like splitting your daily, weekly, or monthly deposits up once they reach the app into your different goal or giving buckets, you have 100% control over the moves you make!

This Is Risky Business – But Not Really

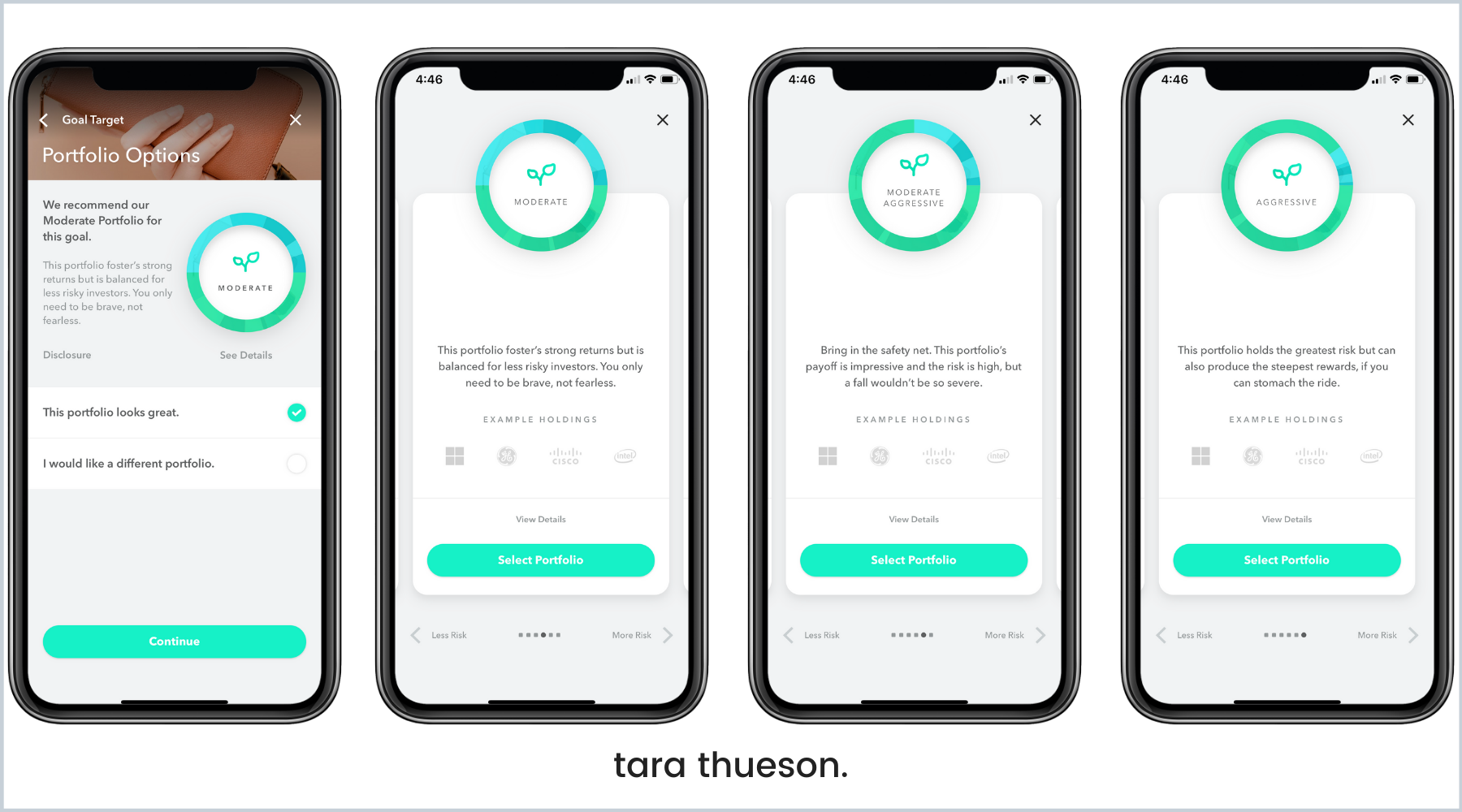

With Vimvest, you only invest at the level you’re comfortable with! You can be very conservative or be moderate, moderately aggressive, and aggressive in your investment choices! But that’s it – no additional work is required from you. Either way, Vimvest puts Nobel Prize investing science to work with their diversified portfolios for your distant or long-term goals.

Setting Your Goals

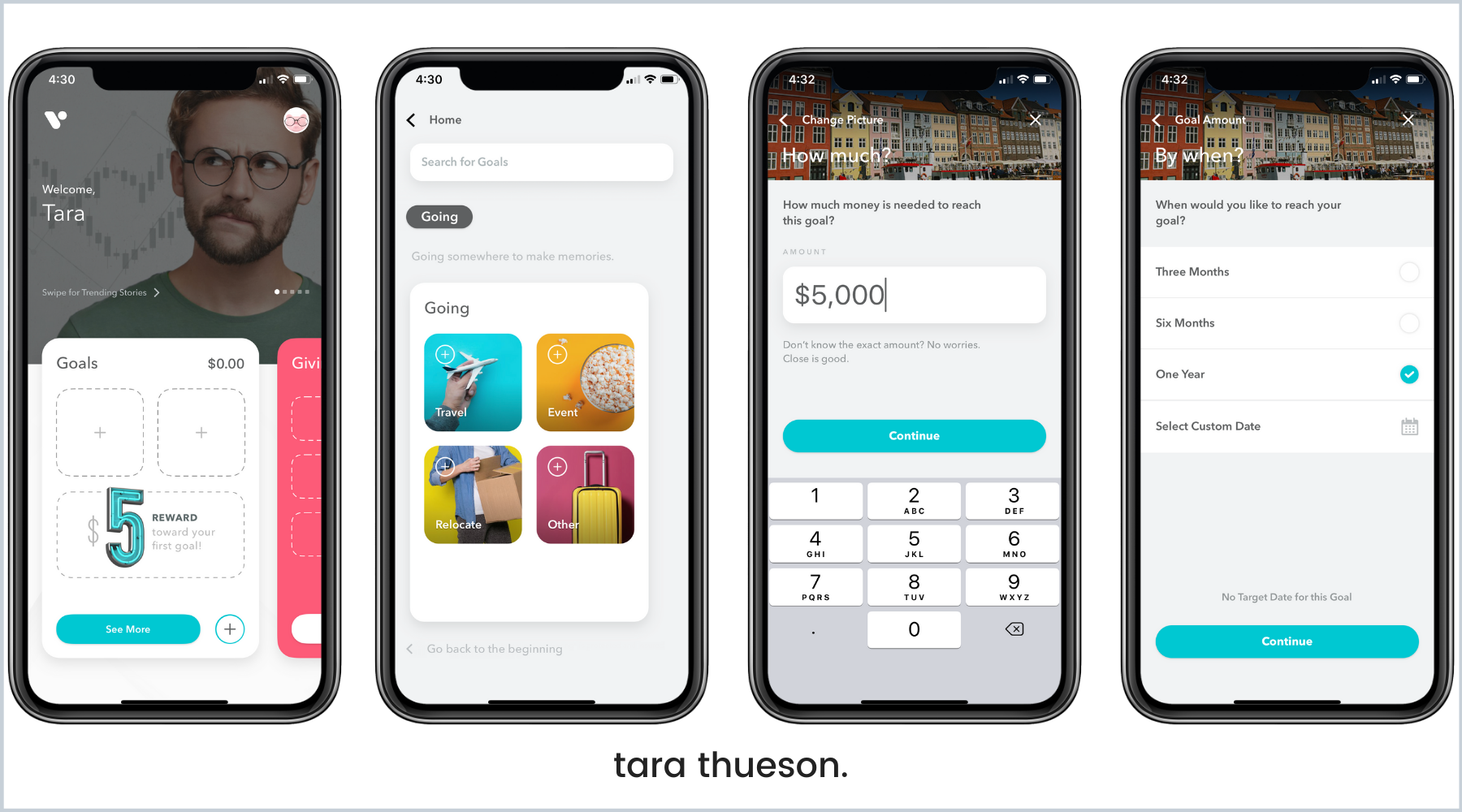

Setting a new goal is as easy as 1-2-3! You can save for your next vacation, big purchase, memorable event, and more. Think of it as your own personal powered wishlist for visualizing your future.

- Tap the ‘+’ sign to begin a new goal

- Type in the goal you’d like to set or select one from one of the many prompts!

- Set how much money is needed to reach your goal

- Set a deadline for when you would like to reach your goal

Depending on the length of your goal, Vimvest will determine whether or not your goal timeline is long enough to make investing worth it. In my experience, goals with less than 6 months on their timeline typically aren’t worth investing.

Once your goal is set, Vimvest will show you the amount it will withdraw from your bank account and deposit into the app each day, week, or month. The frequency of deposits is up to you!

Saving Made Simple

If you’ve ever tried to create a savings habit, you know how difficult it is to get started. After opening a separate savings account, you begin to put as much money as possible into it each month.

And then disaster strikes! Your basement floods, your car tire goes flat, and you find out that your 3rd kid needs braces…you just can’t catch a break! So you break into your savings and then you’re back to square one…

What I love about Vimvest is that I almost don’t even notice that I’m saving money. The amounts I’ve set are small enough that the deposits don’t stand out amongst grocery hauls, Starbucks purchases, or Target runs. It really is saving made simple. And the investing is a huge added benefit! Can you honestly say you’re comfortable investing on your own?

Me neither! But with Vimvest, I have the opportunity to make my money work for me – at a risk level I’m comfortable with.

Either way, the app is definitely worth checking out! And right now when you use the code TARA10 as your referral code, you’ll get $10 put in your goal account right away! For doing nothing!

Isn’t it about time that money was made simple?

Download the Vimvest app HERE and then use my referral code TARA10 to get your $10 to jumpstart your first goal! Thank you Vimvest for sponsoring this post and making it safe and easy for us to save, give, and invest!

Xx Tara